Humanity Art Fund

Supporting Artists to Promote African Works

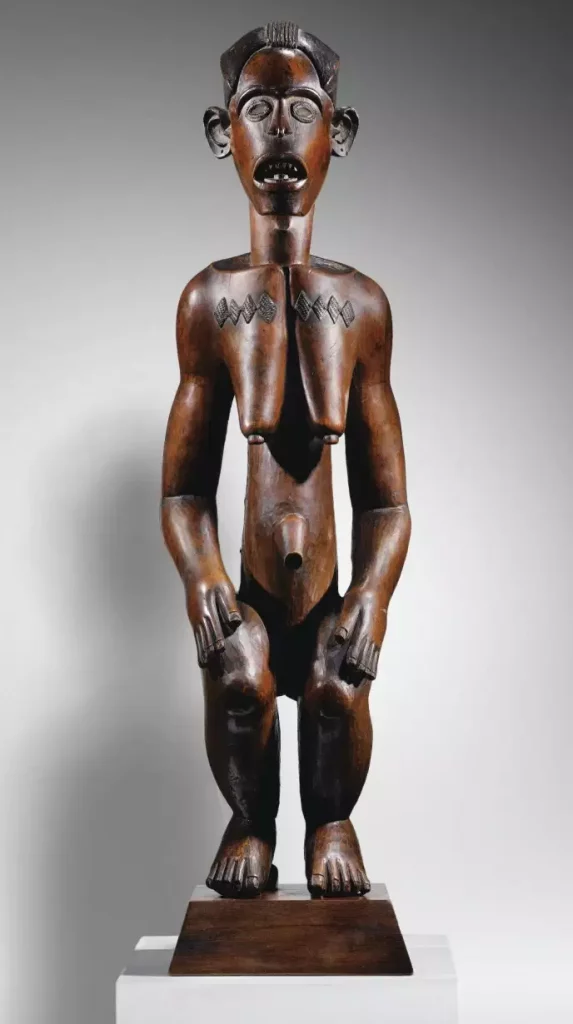

The influence of primitive arts, mainly from Africa, in the abundant work of the Spanish genius Picasso only proves the artistic richness of Africa.

Structuring the market with the continent's players as well as the listing of our artists, giving back to Africa its values and the source of its inspirations; these are our ambitions by financially supporting African and Afro-Descendant artists in their exhibitions and the marketing of their works.

The primary objective is to encourage African financial institutions to promote and invest in the continent's cultural heritage by creating an investment fund dedicated to art.

At G.F.C.I.E, we believe that art is a witness to the passing and future of time. It allows us to better understand our painful history, in order to build a better future.

Contemporary African Art: A Global Emergence

Contemporary African art is occupying an increasingly prominent place on the international scene.

Emerging African artists are now given a place in major international fairs: Frieze, Fiac, Fondation Cartier.

2004, Africa Remix is an international traveling exhibition that represents a panorama of contemporary African artistic creation. Under the aegis of its main curator Simon Njami, it was held successively at the Kunstpalast Museum in Düsseldorf from June 24 to September 7, 2004, at the Hayward Gallery in London from February 10 to April 17, 2005, at the Centre Georges Pompidou in Paris from May 24 to August 15, 2005, at the Mori Art Museum in Tokyo from April to June 2006, at the Modern Museet in Stockholm from October 14, 2006 to January 14, 2007, and at the Johannesburg Art Gallery in Johannesburg from June 24 to September 30, 2007.

This exhibition is part of an effort to raise awareness and awareness of contemporary art located outside the West. The exhibition featured 200 works by 87 artists of very different styles and was organized around three themes: identity and history, city and land, body and mind.

- In 2013, in London, a fair was entirely dedicated to African art, 1:54, created by Touria El Glaoui.

- 2016 First museum of contemporary African art created by businessman and collector Jochen Zeitz.

- 2016 Akaa & Also Known as Afrika, created by Victoria Mann.

- 2016 In London, Sotheby's creates an African art department.

- 2017, the Louis Vuitton Foundation exhibits the Jean Pigozzi collection.

- 2017, the Zeitz MoCAA, the world's first museum of contemporary African art on African soil in Cape Town.

- 2018, the first African continental fair opens in Marrakech

AKAA.Also Known as Africa, created by Victoria Mann.

1.54, created by Touria El Glaoui.

Dakar Biennale.

Aïda Demba Cisse

TAXATION OF WORKS OF ART FOR INDIVIDUALS AND BUSINESSES.

Individuals.

Works of art are not subject to the Real Estate Wealth Tax (IFI).

In the event of resale, the capital gain is taxed. The taxpayer has the choice:

or to be taxed at a flat rate on the sale price at a rate of 6 % for jewelry, works of art, collectibles or antiques. If the seller or exporter is domiciled for tax purposes in France, the CRDS at the rate of 0.5 % is also applicable. The overall rate is therefore 6.5 %. The tax declaration is accompanied by its payment.

or to be taxed under the ordinary capital gains regime. In this case, this capital gain will benefit from a reduction of 5% per year of ownership beyond the second year: it can therefore be entirely exempt if the work has been owned for more than 22 years. The owner of the work must be able to provide proof of the length of ownership in order to benefit from this reduction (invoice, purchase certificate or extract from the inheritance tax return).

You must declare the capital gain on form no. 2091 if you choose flat-rate taxation, otherwise on form 2092.

Art is now purely and simply excluded from the tax base for the Real Estate Wealth Tax, resulting from the 2018 Finance Act.

You can donate your artwork to a museum or a public interest or non-profit organization. By doing so, you not only contribute to the preservation of heritage, but you also reduce your taxes. And not just a little: 66 % of the value of the donated property can be deducted from your income tax, up to a limit of 20 % of your taxable income.

Sale of works of art: taxes and deductions.

The taxation of works of art depends directly on the sale price:

Below €5,000, the sale is not taxable. This applies regardless of the buyer: a museum, a library, or an archive service (accredited by the Ministry of Culture).

Above €5,000, the sale is subject to taxation. The seller can choose between two taxes:

A tax on the total sale,

A capital gains tax.

Sales tax.

It applies to all sales of works of art by an individual. It amounts to 6.5 % (including 0.5 % for CRDS), automatically applied to the sale price, even in the absence of a purchase invoice.

Capital gains tax.

If he does not wish to be taxed on the total of his sale, the individual seller can opt for taxation on the capital gain only. In this case, he will have to pay income tax at the rate of 30 % (12.8 % on income and 17.20 % in social security contributions). Note that with this option, he benefits from a reduction mechanism of 5 % per year of ownership from the 3rd year. This amounts to a complete exemption from tax and social security contributions beyond twenty-two years of ownership.

Flat rate tax or capital gains tax: how to choose?

If you already know that you won't be keeping your artwork for long before reselling it, the flat-rate tax is particularly advantageous. The same applies if the capital gain is significant. However, in the long term, capital gains tax is preferable. Note that if you don't know the artwork's origin or its purchase price, the first option may be taxed upon resale.

Companies:

A tax deduction over 5 years.

If your business purchases an original work of art, you can deduct it from your taxable income in equal amounts. This can be done from the first year of purchase and for the following four years.

Please note that each fraction deducted must not exceed the limit of 5 % (5 per 1000) of turnover.

For example, if you have a turnover of €300,000, you can deduct €1,500/year. So over 5 years, this represents a work of art worth €7,500.

Limitation of deduction

The amount of acquisitions of works or musical instruments are taken into account for the calculation of the tax deduction within the higher limit between 5 % (5 per 1000) of turnover and 20,000 €. This limit is further reduced by payments made as donations (article 238 bis of the CGI) which gives the right to a tax reduction of 60 %. Donations are also retained within the limit of 5 % (5 per 1000) of turnover.

Conditions for deducting the purchase of works from your income

Not all artwork is eligible for a business deduction. To deduct the purchase of an artwork from your income, the artwork must be:

Acquired from a living artist.

Purchased directly from the artist or through an intermediary in the art market (galleries, art dealers, public auctions, etc.).

The work can also be a musical instrument. You can then benefit from the tax reduction for the purchase of a work of art if you agree to lend this instrument free of charge to performing artists who request it.

Enter the work of art as an asset on the balance sheet.

Subsequently, you must:

Exhibit the work in a location accessible to the public or company employees for 5 years: building lobby, waiting room, etc., excluding your offices. The work of art can also be entrusted to a museum or placed on deposit with local institutions (region, department, municipality or their public establishments).

Enter the work of art as an asset on the balance sheet.

Taxation

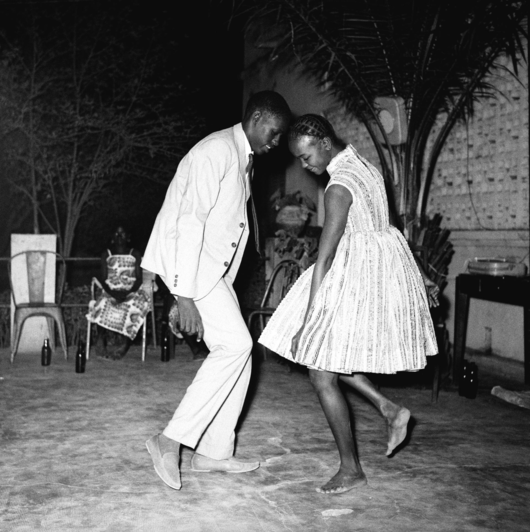

Success of contemporary African art